Last updated on May 6th, 2023 at 02:29 pm

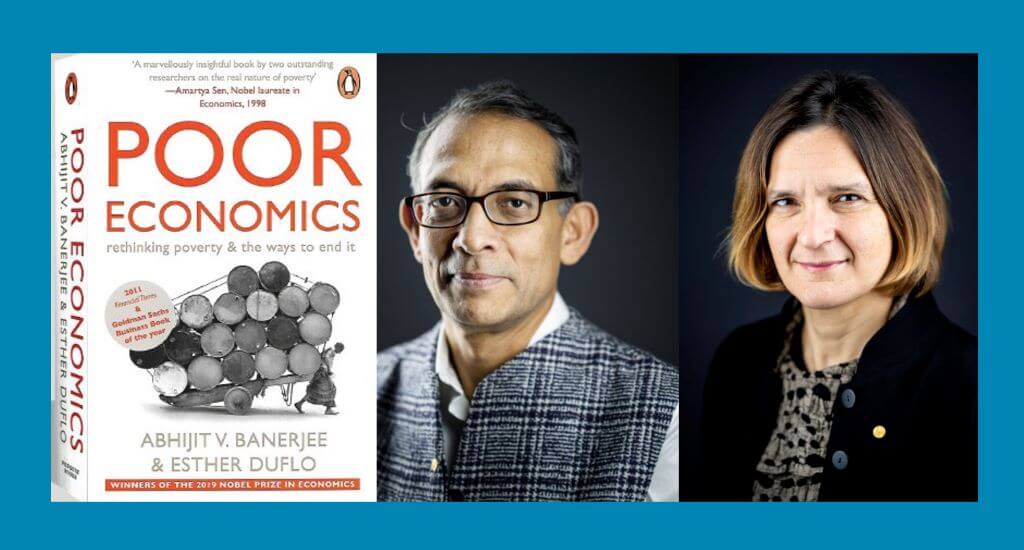

In Poor Economics: A Radical Rethinking of the Way to Fight Global Poverty, Abhijit Banerjee and Esther Duflo challenge the traditional methods of addressing poverty and offer innovative solutions that are both effective and feasible. Drawing from their extensive research and fieldwork in developing countries, the authors provide a thought-provoking analysis of the root causes of poverty and propose practical solutions to alleviate it. Their insightful and accessible writing makes it a must-read book for anyone interested to know about poverty in-depth in the modern world.

The 2019 Nobel Prize winners in Economic Sciences for their ‘Experimental Approach to Alleviating Poverty’ Abhijit Banerjee and his wife Esther Duflo’s book Poor Economics is a fascinating and convincing read. Poor Economics, rethinking poverty and the ways to end it, has come into the public discussion after the authors won the prize.

Background

Indian-born Abhijit Banerjee and French-born Esther Duflo were awarded the prize combined with another economist Michael Kremer of Harvard University, Cambridge, USA. The authors’ pioneering concept of Randomized Control Trials (RCT) is compellingly presented regarding what impacts the poor and what doesn’t in alleviating poverty.

Poor economics is a must-read for the people who care about the poor and poverty; the poor and their economic behaviour and what should be considered with regard to alleviating poverty. The question, whether charity and hand-outs are doing any good or are counterproductive in the way to reducing poverty’ the book brings your answer.

Astonishingly enough, I have found myself relatable in every case study they presented to describe ‘why the poor do what they do’. Growing up in a poverty-stricken family, I know how it feels to be poor very well. I had been, consistently, forced to position my family and myself with characters they described, and with behaviour, they observed among the poor people. In many ways, Poor Economics has reminded me of my childhood days when I had to witness all debacles caused by poverty and unending financial constraints.

It is interesting, and scary at the same time, to know how socioeconomic privilege plays a vital part to make who were today. Intelligence, productivity and physical and mental well-being to a large part depend on our economic opportunity. The question regarding my cognitive competency and physical productivity has been an infallible suspicion of self-worth.

Notwithstanding, with a lot of doubts concerning the poor and children of the poor and their contribution to society on the ground, I have decided to cite some important aspects of the book.

Notable things of Poor Economics:

The very chapter of the book starts with dissenting views on ‘pro-aid’ and ‘anti-aid’ to the poor to alleviate poverty. The big questions are “What is the ultimate cause of poverty”?, and “How much faith should we place in the free market”? “Is democracy good for the poor”? And so on.

To know the answers to these questions, and to know them from the ideas of many political scientists and economists, one needs to go through the book very carefully. But instead of looking for the answers, I would love to write a few things down that may reveal how important this book is for understanding poverty and poor people’s behaviour toward finance.

To start with ‘aid-question’ Abhijit and Duflo cited two famous political scientists from the West. The ‘pro-aid’ expert Jaffrey Sacks, advisor to the United Nations, and director of the Earth Institute at Columbia University in New York City reasons that, “Poor countries are poor because they are hot, infertile, malaria-infested, often landlocked; it makes it hard for them to be productive without an initial large investment to help them deal with these endemic problems.

But they cannot pay for the investments precisely because they are poor–they are in a ‘poverty trap’. Until something is about these problems, neither the free market nor democracy will do much for them. This is why foreign aid is key: it can kick start a virtuous cycle by helping poor countries invest in these critical areas and make them more productive”.

On the other hand, William Easterly, one of the most ‘anti-aid’ public figures of New York University, and Dambisa Moyo argue that “aid does more bad than good; it prevents people from searching for their own solutions while corrupting and undermining the local institutions and creating a self-propagating lobby of aid agencies. They don’t need hand-outs from foreigners or their government, and there is no ‘Poverty trap’”.

Of the ‘Supply-demand’ argument, Jaffrey Sachs is the proponent of the ‘Supply’ side to emphasise ‘the importance of accessibility of help in the form of aid’, while William Easterly, on the ‘demand’ side, argues that, “there is no point of supplying services, education, for example unless there is a clear demand for it”.

Jeffrey Sachs is in favour of spending more on aid and a believer of the ‘poverty trap’ and “generally believes that things, such as fertiliser, bed-net, computers in school and so on, should be given away and that the poor people s should be entitled to do what we think is good for them”, while Easterly, along with Moyo, refute that aid not only corrupts the government but also at the more basic level we should respect people’s freedom–if they don’t want something there is no point in forcing it upon them: if children do not want to go to school it must be because there is no pony is getting educated.

Hunger is not the root cause that many go hungry

Even though the idea that poor people have a ‘Nutrition based poverty trap’ created by the lack of food and sufficient calories, the authors’ findings suggest that “there is still plenty of food available to survive, to the poor”. They say poor people eat less not because the food is unavailable to them, but because they have something else to do with the money they could have spent on the food that was needed enough.

The authors wrote, “Most people living with less than 99 cents, in the developing countries a day, do not seem to act as if they are starving. If they were, surely they would put every available penny into buying calories. But they don’t”. Why?

They found that a “Typical poor household could spend up to 30 per cent more on food than it does if it completely cut expenditures on alcohol, tobacco and festivals.” Nevertheless, eating to survive and eating to be productive’ are not the same things.

The authors mention research on the effect of nutrition and relations between nutrition and mental and physical conditions by Anne Case and Chris Faxon shoes that, “in the United Kingdom and the United States the effect of height is entirely accounted for by differences in IQ: When we compared who have the same IQ, there is no relationship between height and earnings. What matters is good nutrition in childhood: on average, the adults who have been well nourished and children are both taller and smarter. And it is because they are smarter that they earn more”.

Poor people are undernourished, stunt, under-weight and short because they do not have enough to consume and invest in calorie intake. Because poor people eat tasty food instead of nutritious food. A compelling and unavoidable fact that cannot be disregarded at all. Because grown-up in an impoverished family I had witnessed those circumstances myself. Still, the same repercussions of poverty cannot be true in all cases.

Conversely, what the authors of Poor Economics found in their findings is not less surprising to know. They say that poor people eat less because there is something else more important for them to be concerned about. And in fact, “More important than education, food, deworming pill and bed-nets for malaria prevention. For the poor wedding dowry, christening and funeral ceremonies, TV, DVD and mobile phones are more important than food”.

The psychology behind that is that “These things make life less boring”. Despite saving and spending more on nutritious food intake the poor people focus on “here and now’, on living their lives as pleasant as possible. They do not spend on wholesome and nutritious food, they instead spend on tasty and cheap foods.

Poor people think ‘Cheap’ means ‘valueless”

Poor people are also trapped in a ‘health-based poverty trap’ as they cannot get away from easily preventable diseases. For financial and practical reason, they often choose ‘expensive’ cures rather than ‘cheap’ prevention. They are indifferent towards services life free full immunisation, deworming children, and buying bed nets at subsidised prices. Why? Do they have different worldviews or does something else underlie there?

I am fascinated by the idea behind this behaviour of the poor people: why they consider what is cheap of less value, why they do not get their children immunised or save for possible future health shock.

The authors said there is a psychological fact that plays an important role known as the “psychological sunk cost” effect, meaning people are more likely to make use of something they have paid a lot for. Besides, people may judge quality by price: things may be judged to be valueless precisely because they are cheap”. Therefore, poor people do not always take advantage of subsidised services. For them, the money they spend on subsidised services could have been used on something more pleasant or the time they spend to get their children immunised by waiting in the queue could have been better used for something else.

Education is not for all

As with any other trap, poor people are also trapped in the education system. Poor people do not get the whole benefit of subsidised education because they do not understand the value of it. Investing in education does not correspond to their expectation of their children. Because, authors say, people invest in education, as they invest in anything else to make more money–in the form of increased earnings in the future”.

Poor people are not sure if their children will ever repay them by taking care of them in old age, while many others do so only reluctantly or they simply default. Moreover, parents feel adequately repaid even if their children do well and can share with their neighbours. That’s why it may happen that in poor families only exceptionally talented children can have the privilege of education. What are the constraints, family size or incapability of investment?

-Poor Economics

Therefore, as every child is accounted for an extra hand in household work that propagates an extra bit of food production in the survival process. Children are seen as parents’ economic features, like an insurance policy, a saving product, or a lottery ticket, all that comes in one package.

Policy, politics and the poverty

In the chapter on Institutes of Poor Economics, they detailed how poor people try to diversify the risk of possible financial hits and agricultural shock in various ways. It is truly amazing how poor people devise a coping mechanism to tackle the dire economic situations when their business fails, and crops are damaged because of changing weather patterns. When poor people lose their employment, it makes them worried which causes them to be stressful and depressed. Because of depression, they lose their cognitive and decision-making ability.

Poor people do not think of buying formal Insurance. They help each other when in need instead of formal insurance. This help and assistance to each other come in many different ways and fashions. That explains why they don’t need insurance or cannot afford one. Why poor people don’t want the insurance that is offered for the ‘catastrophic scenario’ available in the market is expounded in chapter six.

Poor Economics also elaborately discusses whether Microfinance is and not a miracle in poverty reduction efforts. Along with the Grameen Bank of Bangladesh and Spandhana (India’s largest Microfinance Institute or MFI), Microfinance Institutes’ strengths and limits are brought in a broad perspective.

They tell us why poor people still want to borrow from traditional moneylenders even at a higher rate of interest than borrowing from formal microfinance institutions at a lower rate of interest.

They found that for the poor people, it is always hard to borrow from the Microfinance Institutes, while they can only be eligible for only around $400 at best if they ever get any loan. This tells us why the poor borrowers are prevented from taking the risk of trying entrepreneurial endeavours to make their businesses bigger. Therefore, how successful the Microfinance Institutes is debatable. Still, there are very few such enterprises targeted at the poor while banks do not run the risk of lending to the poor for fear of default.

It is equally interesting to know about poor people’s saving behaviour. They, they say, save, if they ever do, ‘Brick by Brick’, because they have very little to no access to the formal saving systems, like banks.

Along with systemic constraints poor people’s psychological perception toward saving plays a vital role. The authors’ finding is that “the poor people’s visceral needs (as sex, sugary tea, fatty food, cigarettes) are always there. And the lack of self-control toward those needs, as well.

One of the main reasons could be the ‘time inconsistency’ regarding ‘tomorrow’s self’ and ‘today’s self’. Because “the human brain processes the present and the future very differently. Our vision of how we should act in the future that is often inconsistent with the way we act today and will act in the future”.

The last chapter “Politics and Policies’ describes systemic corruption of the state, failure to implement policies, ineffective policies and dereliction of duty for which a person is responsible. The chapter brings together many of my political scientists and economist such as Acemoglu, Robinson and Paul Collier with a very captivating discussion on politics, policy and development.

The authors say, “Good policies will emerge eventually if politics are right. But without good politics, it is impossible to design and implement good policies. A social revolution such as the transition of effective democracy cannot happen in a country infested with corruption”. Moreover the exponent of ‘poverty trap’ and ‘supply’ side Jeffrey Sachs, “Sees corruption as a poverty trap because poverty causes corruption and corruption causes poverty”.

He suggests breaking the trap by focusing on making people in developing countries less poor: aid should be given for specific goals (such as malaria control, food production, safe drinking water and sanitation) that can easily be monitored. Raising living standards would empower civil society and government to maintain the rule of law. This makes it possible to successfully implement such large scale programmes in poor, corrupt countries.

Daron Acemoglu and James Robison conceptualise institutions in capital letters —“economic INSTITUTIONS like property right or tax system; political INSTITUTIONS like democracy or autocracy, centralised or decentralised power, universal or limited suffrage”. They say that these broad institutions are prime drivers of the success or failure of a society.

The authors cited the advocate of ‘free market’ William Easterly who says that, “Freedom means both as much political freedom and as possible economic freedom, that is, free markets. The ‘free market’ will give the would-be entrepreneurs opportunities to start their ventures and create wealth if they are successful. They went on saying that “if a state is weak or corrupt the ‘free market’ will tend to naturally emerge via bribe and corruption”.

Power to the poor, keeping corruption in check, making people aware of the corruption, and handing the power to the poor people–instead of the elite–are discussed brilliantly in the preceding chapters.

Corruptive behaviour of the people in the public service of the state summed up: Extreme poverty makes it necessary to give away a lot of services at well below market prices. Government enforcement to people to do something whose value they do not appreciate, free services to people that come at a lower price than they should have been paid for, underpaid and overworked bureaucrats are the risk factors of corruption.

In the Conclusion, the authors reminded us that “This book is in a sense, Just an invitation to look closely if we resist the kind of lazy formulaic thinking that reduces every problem to the same set of general principles; if we listen to Poor people themselves and force ourselves to understand the logic of their choices, if we accept the possibility of error and subject every idea, including, the most apparent, commonsensical ones, to rigorous empirical testing then we will be able to not only to construct a toolbox of effective policies but also to better understand why the poor live the way they do.

Conclusion

I conclude by saying that Poor Economics by Abhijit Banerjee and Easter Duflo is perhaps one of the most influential and informative books written for the poor from the poor people’s point of view. With huge research and interview-based findings from the poor people make it is worth reading.

The authors talked about the poor alone, they lived with the poor and witnessed the malady of poverty themselves. By presenting the contemporary debate on ‘aid or not’ they have just tied to show us that argument will not reduce poverty. Because both sides’ argument stands true to their point of view, with evidence.

I hope that reading Poor Economics will help us see the poor, poverty and politics in a different but benevolent vein.