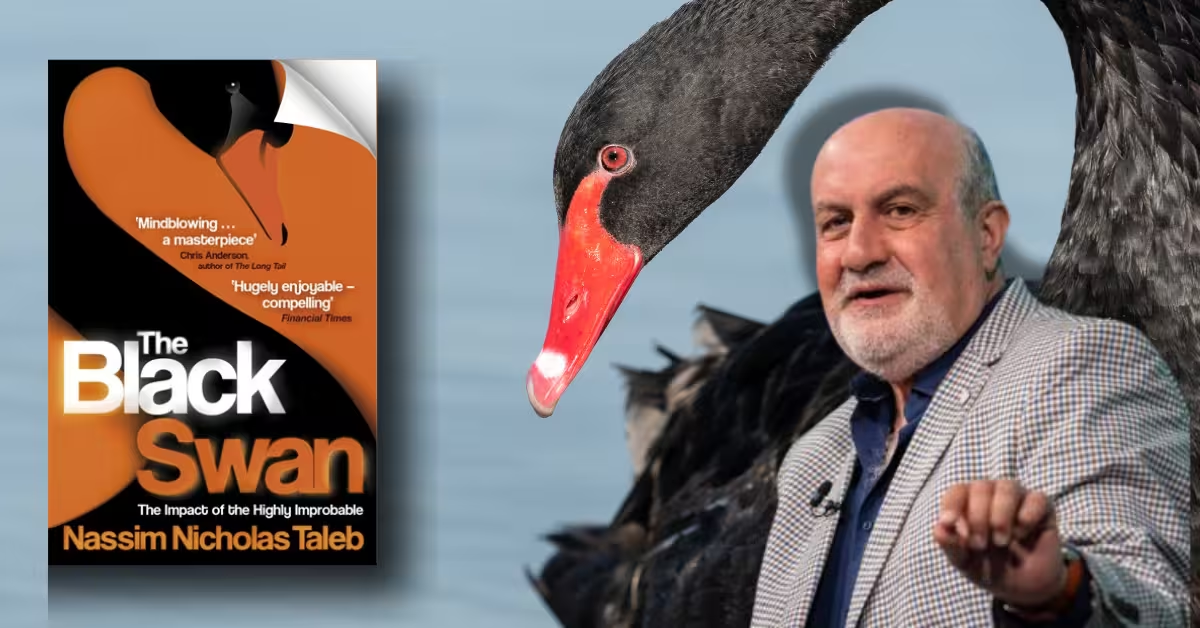

Nassim Nicholas Taleb’s The Black Swan: The Impact of the Highly Improbable was published in 2007 by Random House (U.S.) and Allen Lane (U.K.). A central work in his Incerto series, it explores the far-reaching consequences of rare, unpredictable events and how our understanding and predictions fail when confronted by such events.

The book delves into epistemology, randomness, and how societies misunderstand uncertainty. Taleb, a former options trader turned scholar, uses this book as a platform to critique the often simplistic views on forecasting and risk management found in mainstream science, economics, and finance.

At its core, The Black Swan argues that rare, high-impact events—”Black Swans”—shape the world far more than most think. It asserts that we often underestimate these events because of cognitive biases, such as over-reliance on past data to predict future outcomes.

Taleb’s thesis does not call for predicting these events but for building systems that can withstand their effects.

Table of Contents

Background

Taleb’s background as an options trader provides the foundation for his critique of traditional forecasting methods.

His extensive experience in financial markets and his interactions with prominent intellectual figures gave him a unique perspective on randomness and human error. His prior work, Fooled by Randomness (2001), laid the groundwork for The Black Swan, where he further develops the idea of randomness as a fundamental force in life and markets.

Summary

Part I: Umberto Eco’s Antilibrary, or How We Seek Validation

- Umberto Eco’s Library Analogy:

- Taleb starts by discussing Umberto Eco‘s concept of the “antilibrary,” a collection of unread books that holds greater value than those that have already been read. This idea is rooted in the notion that our knowledge is limited, and the more we learn, the more we realize how much remains unknown.

- The antilibrary symbolizes an acknowledgment of uncertainty and highlights how we tend to focus on what we know rather than what we don’t know.

- Bias Toward the Known:

- Humans tend to focus on what is familiar, making it harder to appreciate and deal with the unknown. Taleb argues that this bias limits our ability to anticipate rare events (Black Swans).

- Eco’s library stands as a metaphor for intellectual humility—recognizing that much of the world’s knowledge remains outside our grasp, and this acknowledgment should influence how we view information and prediction.

- The Problem of Overconfidence:

- We overestimate our understanding and certainty about the world. This is exacerbated by our tendency to anchor our knowledge in things we can easily access or understand, thus ignoring vast swaths of information that could be critical.

- Epistemic Humility:

- Taleb advocates for a mindset shift from treating knowledge as a trophy to recognizing it as a tool. By acknowledging the vastness of what we don’t know, we can better prepare for unpredictable events.

Part II: We Just Cannot Predict

- The Scandal of Prediction:

- Taleb delves into the absurdity of predictions, particularly in complex domains like economics and finance. These predictions are often based on flawed assumptions, and the accuracy of predictive models is severely limited.

- He highlights that prediction is rooted in the false belief that we can model rare events or predict future outcomes with precision.

- The Limitations of Knowledge:

- Taleb underscores the problem of over-reliance on experts who make predictions, often based on incomplete or misleading data. He points out that these experts rarely acknowledge the limits of their knowledge or the uncertainties inherent in the systems they study.

- The Narrative Fallacy:

- Humans create narratives to explain past events, even when those narratives oversimplify or distort reality. This fallacy, according to Taleb, leads us to mistakenly think that we understand events and can predict the future based on past patterns.

- By focusing on the known (and building a coherent story around it), we fall victim to this narrative fallacy, believing that things are more predictable than they actually are.

- The Scandal of Prediction in Business:

- In business, especially in financial markets, prediction errors can have catastrophic consequences. The overconfidence in predictive models often leads to financial crises or lost fortunes, as seen with the 2008 economic collapse, which was largely unpredicted.

Part III: Those Gray Swans of Extremistan

- The Nature of Extremistan vs. Mediocristan:

- Taleb introduces a crucial distinction between Mediocristan (a world governed by predictable, bell-curve-type randomness) and Extremistan (a world where rare, extreme events dominate). Mediocristan’s events are typically evenly distributed and predictable, while in Extremistan, events are skewed, and outliers (Black Swans) have an outsized impact.

- The Bell Curve Fallacy:

- One of the key critiques Taleb makes is against the reliance on the Gaussian “bell curve” in statistics. He argues that this model fails to account for the highly improbable, extreme events that occur in areas governed by Extremistan.

- While the bell curve assumes a normal distribution, real-world data often exhibits “fat tails,” where extreme events (both positive and negative) are far more common than the model suggests.

- Gray Swans:

- Taleb discusses gray swans, which are rare but more predictable than Black Swans. These events are within the realm of possibility, and while they are still rare, they should not be as shocking as completely unforeseen Black Swans.

- Understanding “gray swans” allows us to reduce the shock from Black Swans by preparing for possible extreme events, even if they are not predictable in the strictest sense.

- Mandelbrotian Randomness:

- Mandelbrot’s fractals provide a better model for understanding randomness in Extremistan. Fractals exhibit self-similarity across different scales and help us appreciate the fractal nature of many systems, which is different from the smooth, predictable randomness assumed by Gaussian models.

- The framework Taleb proposes allows for understanding extreme risks and mitigating their impact, acknowledging that even though we can’t predict them precisely, we can still prepare.

Part IV: The End

- Reflection on the Human Condition:

- The final section is more philosophical. Taleb reflects on how humans handle uncertainty, rarity, and unpredictability in life. He critiques the overreliance on prediction models and the comfort we take in certainty, even if that certainty is built on false premises.

- The book concludes with a broader metaphysical reflection on life’s fragility. Taleb encourages readers to focus on robust strategies—those that can withstand the shocks of Black Swans—rather than trying to predict or control the unpredictable.

- The Importance of Resilience and Robustness:

- Instead of attempting to predict every potential outcome, Taleb emphasizes the importance of being robust—being able to withstand shocks without being negatively impacted by them. In practical terms, this means focusing on diversification, avoiding exposure to extreme risks, and building systems that benefit from randomness rather than being hurt by it.

- Taleb’s final message is a call for intellectual humility and resilience in the face of an unpredictable world.

This breakdown encapsulates the major themes of The Black Swan in a comprehensive and thoughtful way. It reflects Taleb’s critique of modern knowledge, the dangers of overconfidence, and the limitations of predictive modeling.

At the core, his argument is that the world is more unpredictable than we think, and rather than trying to predict the future, we should build systems that are resilient to its uncertainties.

The book is organized thematically, with a narrative style that intertwines personal anecdotes, history, and scientific theory to engage readers in understanding the limitations of knowledge and prediction.

The first part challenges the reader’s understanding of the world, and the latter part provides strategies to cope with the chaos of an unpredictable world.

Critical Analysis

Evaluation of Content

Taleb’s arguments are provocative, suggesting that the failures of prediction in finance, economics, and even history stem from systematic biases in our cognitive framework.

He critiques reliance on standard models (like Gaussian distributions) to predict unpredictable events. His perspective forces a reevaluation of conventional wisdom, making a powerful case for accepting uncertainty and randomness.

However, some critics feel that his approach, while insightful, can be overly dismissive of attempts to understand or predict these events systematically.

Style and Accessibility

Taleb’s writing is deeply intellectual, yet he presents his complex ideas through stories and metaphors, making them accessible to a broader audience. He balances technical analysis with engaging storytelling, making challenging concepts more palatable without oversimplifying them.

Themes and Relevance

The themes of epistemic humility, unpredictability, and risk are increasingly relevant in today’s world, where global events—from economic crashes to pandemics—prove that our predictions are often inadequate. Taleb’s critique of the financial industry, with its reliance on flawed predictive models, resonates more than ever.

Author’s Authority

Nassim Taleb brings substantial expertise to the subject, with his experience as a trader, philosopher, and scholar. His credentials lend credibility to his critique of traditional models and his broader philosophical stance on randomness and knowledge. However, some detractors argue that his criticism of other scholars can sometimes come across as overly combative.

Strengths and Weaknesses

Strengths

- The Black Swan offers a refreshing perspective on the limitations of human knowledge. Taleb’s insistence on building systems that can thrive amidst uncertainty is an insightful call to arms for industries like finance, healthcare, and even politics.

- His use of metaphors and narrative storytelling brings clarity to complex philosophical ideas, making them accessible to a wider audience.

Weaknesses

- While Taleb’s arguments are compelling, they can sometimes feel one-sided or dismissive of the value of prediction altogether. His approach might appear too radical for readers accustomed to more structured predictive models.

Reception/Criticism/Influence

The Black Swan has had a profound impact since its release, receiving widespread praise for its critique of forecasting and its call for systems that embrace uncertainty. It spent 36 weeks on the New York Times bestseller list and has been cited over 10,000 times.

Critics like David Aldous have acknowledged Taleb’s contributions to understanding randomness, though some question the applicability of his ideas outside of finance . Despite this, the book has influenced scholars across fields, including economics and risk management.

Quotations

- “The problem with experts is that they know too much.” — This quote captures Taleb’s central critique: expertise can often blind us to the randomness and complexity of the world.

- “We are blind to our own blindness.” — Reflecting on human cognitive biases, this quote calls for humility in the face of uncertainty.

What is Black Swan Paradox

The Black Swan Paradox of Black Swan theory in Nassim Nicholas Taleb’s The Black Swan refers to the paradoxical nature of rare, highly impactful events—known as Black Swans. The paradox centers around two key ideas:

- Rarity and Impact: Black Swans are incredibly rare and unpredictable, but when they occur, they have extreme and often catastrophic consequences. These events defy conventional expectations and are typically outside the realm of what was previously considered possible.

- Retrospective Predictability: After a Black Swan event occurs, people often rationalize or create narratives to explain why it happened, as if it could have been predicted all along. This is the paradox: while these events are unforeseeable in advance, humans have a tendency to “explain” them after the fact, making them seem more predictable than they actually were.

The paradox challenges the way we think about knowledge, prediction, and risk. Taleb argues that we tend to ignore the extreme and unpredictable outliers (Black Swans), focusing instead on what is normal or expected, which leads us to underestimate their possibility and impact.

This paradox highlights the limitations of our understanding and the flaws in forecasting systems that fail to account for the possibility of rare, high-consequence events.

Comparison with Other Works

Nassim Nicholas Taleb’s The Black Swan: The Impact of the Highly Improbable offers a radical rethinking of how we approach uncertainty, risk, and prediction. The book stands out not just for its critique of traditional forecasting methods, but also for its deep philosophical and psychological reflections on human behavior in the face of randomness. Taleb’s work draws comparisons to several other influential works that deal with risk, uncertainty, and the limits of human knowledge. Here’s a look at how The Black Swan compares with other significant works:

1. Fooled by Randomness (2001) by Nassim Nicholas Taleb

- Connection: The Black Swan is often seen as a continuation of Taleb’s earlier work, Fooled by Randomness. While Fooled by Randomness examines how people mistake randomness for skill or foresight, The Black Swan builds upon this by addressing the impact of rare, high-consequence events that are often overlooked.

- Comparison: Both works critique the human tendency to misunderstand randomness, but The Black Swan takes this further by focusing on rare, unpredictable events (“Black Swans”) that can have massive impacts, while Fooled by Randomness mostly concerns itself with the randomness in daily life and financial markets. Taleb also introduces the distinction between Mediocristan (predictable, normal distributions) and Extremistan (the domain of Black Swans) in The Black Swan, which wasn’t as developed in his earlier work.

2. Thinking, Fast and Slow (2011) by Daniel Kahneman

- Connection: Daniel Kahneman’s Thinking, Fast and Slow explores human cognitive biases and decision-making processes. His book provides an in-depth analysis of how people use intuitive (System 1) and deliberate (System 2) thinking when making decisions, which often leads to errors in judgment.

- Comparison: Like Taleb, Kahneman highlights the flaws in human thinking, but Taleb focuses specifically on the misperception of rare, extreme events (Black Swans), while Kahneman addresses more general cognitive biases like overconfidence and the anchoring effect. Kahneman’s focus is on understanding how we make decisions in general, while Taleb’s primary concern is how we misjudge risk and uncertainty, particularly when faced with events that defy normal expectations.

3. The Signal and the Noise (2012) by Nate Silver

- Connection: Nate Silver’s The Signal and the Noise explores the challenges of making predictions in an era of data overload. Silver discusses how identifying meaningful signals in vast amounts of noise is key to forecasting, and he examines the failure of various prediction models, especially in areas like economics and politics.

- Comparison: While Silver’s work is also concerned with the failure of prediction, Taleb’s critique is more radical. Silver argues that better data and improved models can help reduce uncertainty, while Taleb suggests that the very nature of rare, high-impact events makes them fundamentally unpredictable. Taleb would argue that no amount of data can predict Black Swans, whereas Silver is more optimistic about the potential of data science to find patterns.

4. Antifragile: Things That Gain from Disorder (2012) by Nassim Nicholas Taleb

- Connection: Antifragile is another book by Taleb that expands on the ideas in The Black Swan. In Antifragile, Taleb introduces the concept of antifragility—systems that become stronger under stress or disorder, in contrast to fragile systems, which break down under pressure.

- Comparison: Whereas The Black Swan focuses on the unpredictability of rare events and their impact, Antifragile offers a solution to navigating a world filled with uncertainty. It emphasizes that instead of trying to predict Black Swans, individuals and institutions should build systems that thrive on uncertainty and volatility. Thus, Antifragile is somewhat of a follow-up to The Black Swan, offering practical advice on how to adapt to a world defined by unpredictable risks.

5. The Rational Optimist (2010) by Matt Ridley

- Connection: Matt Ridley’s The Rational Optimist argues that human progress is driven by the capacity for innovation and cooperation, even in the face of challenges. Ridley expresses optimism about the future, suggesting that human ingenuity can overcome even seemingly insurmountable odds.

- Comparison: Ridley’s optimism contrasts sharply with Taleb’s more cautious and skeptical outlook in The Black Swan. While Ridley emphasizes the positive outcomes of human collaboration and technological progress, Taleb warns of the dangers of overconfidence, particularly in forecasting. Taleb’s focus is on the catastrophic consequences of rare events, whereas Ridley believes in the power of human adaptability and the ability to learn from history.

6. Outliers: The Story of Success (2008) by Malcolm Gladwell

- Connection: Malcolm Gladwell’s Outliers examines the factors that contribute to exceptional success, emphasizing the role of opportunity, culture, and timing in shaping extraordinary individuals.

- Comparison: While Gladwell focuses on the importance of opportunity and timing in success, Taleb is more concerned with the randomness and unpredictability that shape both success and failure.

Taleb’s Black Swan events can dramatically change the course of history in ways that defy any kind of logical prediction, while Gladwell’s success stories tend to focus on factors that are more controllable or understood. Taleb’s work can be seen as a critique of the traditional narratives of success that Gladwell often highlights.

7. Superforecasting: The Art and Science of Prediction (2015) by Philip E. Tetlock

- Connection: Tetlock’s Superforecasting looks at how certain individuals (super forecasters) can make more accurate predictions than others, based on a combination of analytical skills, open-mindedness, and a deep understanding of uncertainty.

- Comparison: While Tetlock’s work is focused on improving predictive accuracy, Taleb is skeptical of the entire notion that prediction can be reliably improved, especially when it comes to rare, high-impact events. Taleb argues that no matter how skilled forecasters are, they will always be blind to Black Swan events, and the best approach is to prepare for the unexpected rather than try to predict it.

8. Black Box Thinking (2015) by Matthew Syed

- Connection: Black Box Thinking explores how failure can be a learning opportunity, particularly in high-risk fields like aviation and medicine. Syed argues that a culture of learning from mistakes can lead to better decision-making and risk management.

- Comparison: While both Syed and Taleb emphasize learning from failure, Taleb focuses on the failure to predict Black Swan events and the profound impact they can have. Syed, on the other hand, emphasizes incremental improvement through analysis and learning from mistakes. Taleb’s work challenges the assumption that we can manage failure through better models and systems, arguing instead that failure often results from the inability to foresee the most extreme risks.

9. Risk Savvy: How to Make Good Decisions (2014) by Gerd Gigerenzer

- Connection: Gerd Gigerenzer’s Risk Savvy provides insights on how to make better decisions in the face of uncertainty, arguing that humans often overestimate risks based on statistical misinterpretations.

- Comparison: Gigerenzer’s approach is more optimistic than Taleb’s, as it emphasizes improving decision-making through a better understanding of risk. Taleb, however, would argue that even the most rational decision-makers are unprepared for the true scale of Black Swan events, which fall outside of normal statistical understanding. Gigerenzer believes in improving decision-making with better risk literacy, while Taleb focuses on the need for a more robust response to unpredictability.

10. The Art of Thinking Clearly (2011) by Rolf Dobelli

- Connection: Rolf Dobelli’s The Art of Thinking Clearly offers a catalog of cognitive biases that lead people to make faulty judgments. Like Taleb, Dobelli critiques the irrational ways in which we approach risk and decision-making.

- Comparison: Both Taleb and Dobelli challenge the cognitive errors that people make in the face of uncertainty. However, Taleb focuses specifically on the unpredictability of extreme events, while Dobelli’s work provides a broader look at cognitive biases that affect decision-making. Taleb’s focus on the Black Swan event is more profound, as it goes beyond everyday errors to challenge the very way we understand randomness and risk.

Conclusion

In summary, The Black Swan challenges our understanding of risk, randomness, and prediction, urging us to rethink how we approach the unknown.

While its ideas can be unsettling, they are invaluable for those in decision-making positions—particularly in finance, economics, and policy-making.

Taleb’s book offers a unique lens through which to view the unpredictable nature of life, and though it might not offer direct solutions, it empowers readers to better navigate the chaos of an uncertain world. For those willing to confront the complexities of life’s randomness, The Black Swan is a must-read.